Crypto short selling: the AI + Coinmarketcap trick to profitable trades

By Blince Trades, Dec 07, 2025

I bought this web page ad space to publish this free article on short selling nano and micro-cap crypto tokens so you can stop losing money on memecoins, NFT scams or whatever else people gamble away their income on these days.

A nano cap crypto token is a crypto token whose market capitalization is under $50 million and a micro cap is valued between $50 million to $300 million.

First things first. This isn't some magic trick strategy, it isn't without fault, but it's much more effective than many crypto trading courses out there.

What you need:

⦿ A crypto exchange account with a demo trading feature (for practice). You can get this with most crypto exchanges.

⦿ A Generative (Gen) AI app (ChatGPT, Gemini and Perplexity).

⦿ Coinmarketcap (app or use website).

⦿ Some real money (for real profits).

⦿ Snacks.

Got all that? Let's get into it!

What does short selling mean in crypto?

Short selling in crypto means profiting when a cryptocurrency’s price goes down instead of up.

What “shorting” means:

You borrow a cryptocurrency (like BTC or ETH) from an exchange ➜ sell it immediately at the current price ➜ then later buy it back at a lower price ➜ return what you borrowed ➜ keep the difference as profit.

But of course, when you short a crypto token or coin on most crypto exchanges, what you see isn't some borrowing contract staring at you, it feels more like spot trading, only with leverage. I expect that anyone reading this already knows what spot trading is, and how it's different from perpetual trading, where shorting crypto tokens actually happens.

If you're reading this and have no knowledge of these, do yourself a great service by using any of the recommended AI apps above to learn the basics, then come back to this article.

When to short a crypto token

Most people short a crypto token whenever they see a very long green candle on the price chart because they believe that every price surge should experience some pull backs. Sometimes they get lucky, other times, they get liquidated or as Gen Z traders would say: they get smoked.

Don't get smoked, learn when it's valid to take a short position.

There are many reasons to short sell a token such as indication of overvaluation, but being overvalued isn't the strategy we want to follow here. Our strategy is shorting a token when we've concluded that it has been over traded without a reasonable price push by the market, this suggests market manipulation.

The market in this context refers to not just retail investors, institutional investors or independent crypto whales, but also market makers or special trading firms actively participating in these assets markets.

Most crypto token markets have a combination of these entities, bringing in capital, all to make a profit. You should short sell a token when you're confident that everyone's trades signals market manipulation

But how do you know this?

You want to look at how a token’s market capitalization measures up to its spot and derivative (perpetual contracts) trading volume.

When do these things signal market manipulation?

The most important indicator is when the spot trading volume of a token exceeds the market capitalization of said token.

Sometimes tokens hit over $200 million in trading volumes but their market capitalization sits under $100 million.

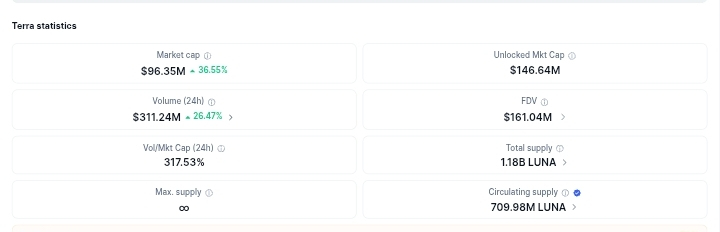

Here's an example. On December 07, 2025, Luna reached over $300 million in spot trading volume while its market capitalization was less than $97 million.

Usually, this leads to derivative markets (perpetual contracts) for these tokens to hit several hundreds and sometimes billions in trading volume. For Luna, over $2 billion was traded on perpetual contracts.

Yet, the token remains under $100 million in market capitalization.

This is proof of market manipulation and an invitation to take short positions for profits.

But here's the most important part.

Use low leverage, irrespective of your trading capital. The reason is because when trading a manipulated market, you're a prey and the predators are looking to take your money.

Some tricks to follow:

Use Gen AI to analyze long term charts (4 hours, 1 day, 1 week, 1 month) to find patterns.

You want to ask the AI to highlight potential points of market manipulation. What were the give-aways and what price points were most favorable to take a short position.

This is important to form a personal add-on insight to the trading strategy.

You also want to use these generative AI apps to find the latest news on these crypto tokens to determine if there are external factors that are contributing to the surge in price and trading volume or not.

In most cases, the lack of external factors makes these markets easier to short for profits because there's less motivation for the market participants creating artificial volume to trade longer-term and potentially squeeze out a lot of short sellers.

That said, there's a generally great time to short any of these manipulated tokens markets and that's by 4:00pm UTC (convert to your local time zone).

But why this time? Most market manipulation sets off around 8:00am UTC, from our analysis, it really heats up between 11:00am to 3:00pm, by 4:00pm, 8 hours of artificial volumes would have been created, with limited price pumps that creates noticeable green (bullish) candles.

Retracements of these pumps are often experienced around this time. In the Chart above, you can see this happening. Regardless of when you find and read this article, find the Luna chart and study December 07, 2025 and see how the markets played out.

Any short opened around early 4:00pm UTC, would have easily generated 10% ROI for the day within minutes at 2x leverage. Repeating this daily compounds significantly. The goal is to keep risks low and hunt artificial volumes for profits.

It might be important to learn candlesticks patterns, as a knowledge of this can aid beginners easily spot trend opportunities and risks even while applying the presented strategy in this article.

You want to use Coinmarketcap filter feature to easily find nano and micro cap crypto tokens whose prices and volumes surge artificially daily.

If you need an advanced step-by-step trading guide with detailed examples, live trading successes using these strategies, send us on our Facebook page. Pricing transparency: our fundamental trading guide is $168. Our most advanced guide is $386.

Want to join smart traders already hacking short selling crypto tokens for sustainable profits with our strategies? Send us a message now!

Disclaimer: The content on this page and all pages of Icoverage.xyz are presented for informational purposes only and should not be considered finance or legal advice.

This page may contain affiliate promotions, see our affiliate disclosure to learn more.

Informations published are not financial advice see our terms of service

We use diverse first and third party softwares on our website, see our privacy-policy

If you found an error, misinformation, or something harmful or unusual on this page please report it now!

This page or pages of this website may contain affiliate links that earn us commissions when you use them at no additional cost to you, see our affiliate disclosure.

© ICPF All Rights Reserved